Economic News

CPI Study Reveals April’s Moderated Inflation yet Persists Strongly

The latest CPI study reveals a slight easing of inflation in April, marking the tenth consecutive month of cooling. However, despite this moderation, price increases remain historically high while the broader economy experiences a slowdown.

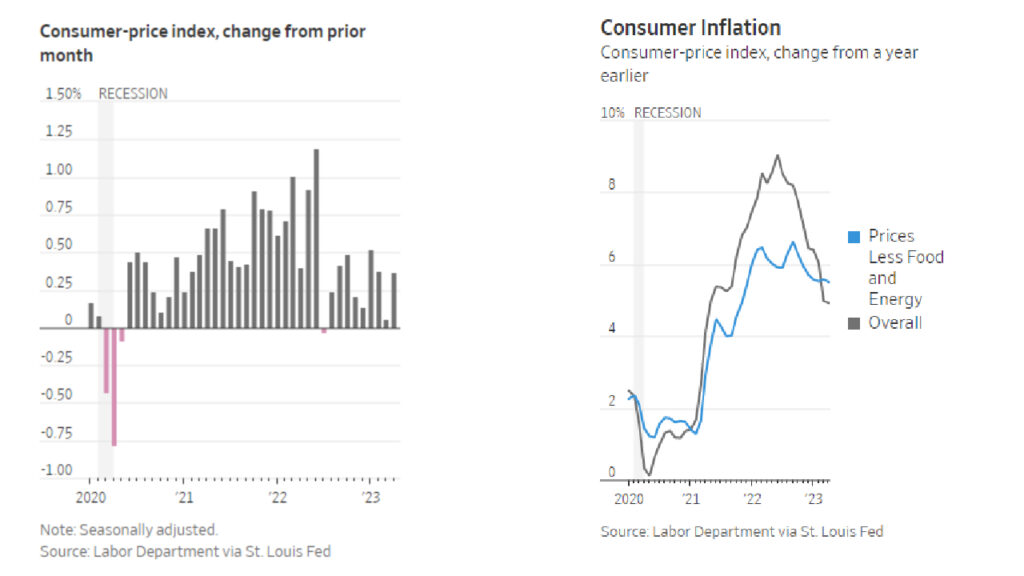

According to the Labor Department, the consumer-price index rose by 4.9% in April compared to the previous year, slightly down from the 5% increase recorded in March. This decline in inflation follows a peak of 9.1% in June 2022.

To curb inflation and slow down economic activity, the Federal Reserve implemented aggressive rate hikes over the past year. The Fed is now monitoring signs of inflation declining towards its target of 2%.

In April, consumer prices saw a seasonally adjusted increase of 0.4% compared to the previous month, in contrast to a 0.1% gain in March. This rise was primarily driven by housing costs and a surge in gasoline prices. The scarcity of inventory led to a significant 4.4% increase in used vehicle prices, while new car prices experienced a modest decline.

Get Wall Street Journal 2-Year Print Subscription Take for $480

The CPI study released on Wednesday may influence the decision of Fed officials to pause rate increases at their upcoming meeting. They have shifted their focus from lagging indicators of economic activity to assessing the impact of recent bank failures on lending conditions and overall economic activity. These effects might not immediately manifest in broader measures of hiring and inflation.

During their most recent meeting, Fed officials raised the benchmark federal-funds rate to a range between 5% and 5.25%, the highest level in 16 years, in an effort to slow down the economy and combat inflation. Fed Chair Jerome Powell mentioned that there were discussions about potentially pausing rate rises after the latest increase. Powell stated, “We feel like we’re getting closer or maybe even there.”

Previously, officials were searching for clear signs of a slowdown to justify halting rate increases. However, Powell indicated that this approach could change, and now officials will require indications of stronger-than-expected growth, hiring, and inflation to continue raising rates. By raising rates, the Fed tightens the economy, resulting in tighter financial conditions such as higher borrowing costs, lower stock prices, and a stronger dollar.

Although the report provides some positive indications of a continued slowdown in price gains, economist Andrew Hunter from Capital Economics suggests that “it does suggest a risk that rates will need to remain high for a little longer than we have assumed.”

Get Wall Street Journal Digital and The Economist for $129

Investors assessed the report and determined a 14% chance of the Fed raising rates at its next meeting, according to CME Group.

The CPI study released on Wednesday also revealed that when excluding volatile food and energy costs, prices rose by 5.5% compared to the previous year, a slightly slower increase than in March. These so-called core prices remain elevated due to persistently high shelter costs, which economists anticipate will cool down in the coming months. Changes in housing prices take time to appear in inflation data due to delays in mortgage and rental contracts.

Economists consider core prices a better predictor of future inflation.

As prices continue to rise, some Americans are making adjustments to their spending habits. Ryan Flick, a 39-year-old Denver resident working in tech sales, used to eat fast food a couple of times a week without it significantly impacting his budget. However, as the prices for his favored meals increased from $5 to $8 a few years ago to over $10 now, he made the choice to cut back. Flick now opts to make sandwiches at home and occasionally splurge on nicer dining experiences.

According to PNC Senior Economist Kurt Rankin, the divergence between food prices remaining flat and prices for dining out rising provides households with the option to mitigate inflation by cutting out at least one discretionary spending indulgence from their routines.