Stock Market

Fear Looms The Stock Market As The Fed Meet to Increase Rates Again

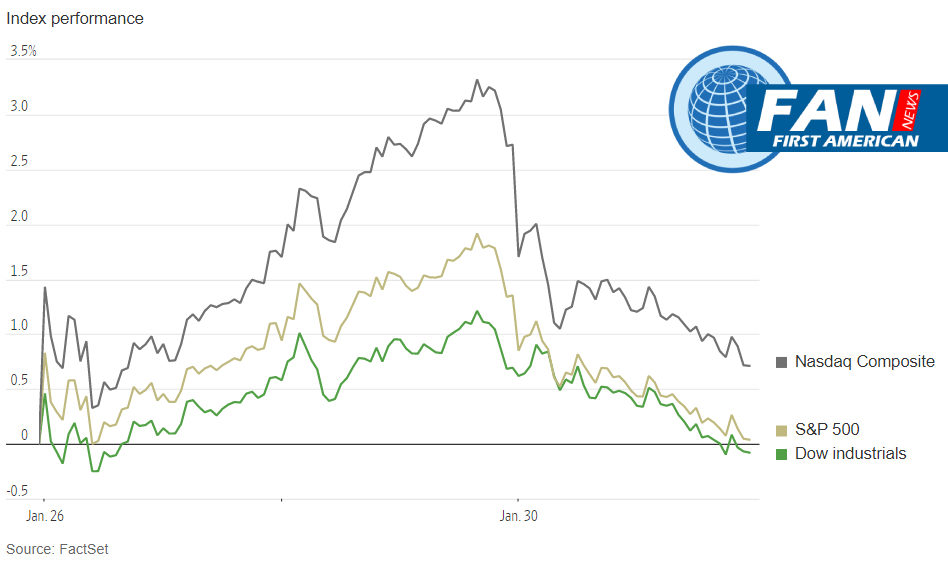

Stock markets have been volatile in recent weeks, driven by signs of softening inflation and hopes that the Federal Reserve will continue to moderate—and eventually halt—its interest-rate increases. U.S. indexes registered solid weekly gains last week, with the S&P 500 adding 2.5%, the Nasdaq Composite jumping 4.3%, and the Dow industrials rising 1.8%.

All 50 of last year’s worst-performing S&P 500 stocks were up this year as of Friday, notching an average gain of 20% through January. In comparison, according to Dow Jones Market Data, 29 of last year’s 50 best-performing S&P 500 stocks were up, posting an average advance of 1.9%.

“You’re seeing a lot of them come back powerfully in January,” said John Quealy, chief investment officer at Trillium Asset Management. Mr. Quealy said he has recently added to tech positions in some strategies.

Investors are gearing up for another significant week of corporate results, with earnings due from more than 100 members of the S&P 500 index. In tech, Spotify and Snap report Tuesday, Facebook parent Meta Platforms follow Wednesday, and the sector giants Amazon, Google parent Alphabet and Apple are all set to report Thursday.

Subscribe today and get 52 weeks of The WSJ Print Edition with daily delivery for $318

“The market has had a flying couple of weeks. But as we get closer to the Fed meeting, cautiousness is certainly going to creep in,” said Seema Shah, chief global strategist at Principal Asset Management. “We will likely see Powell re-emphasizing that they are not at the end yet.”

Fed officials are broadly expected to raise interest rates by a quarter of a percentage point when their two-day meeting concludes Wednesday, lowering the size of the increase for a second straight meeting. Officials are also likely to debate how much further they need to go in taming inflation before pausing rate rises.

Despite that, investors remain cautious about the economy. The Fed, under Chair Jerome Powell, is determined to tame inflation, and many believe the Fed is unlikely to quickly begin lowering interest rates as it has done in the past. Some investors worry that sustained high rates could drag the economy into recession.

Sign up today for unlimited online access to Bloomberg.com for $69

Markets believe that “the bleak period of 2022 could quickly be going into the rearview mirror,” said Stuart Katz, chief investment officer at Robertson Stephens. Mr. Katz clarified optimism is premature, citing the disconnect between investors and the Fed over when to pivot to milder interest-rate increases.

Shares of several major auto makers fell Monday after Ford Motor said it would cut prices and boost its Mustang electric crossover production. Ford’s stock declined 2.9% in 4 p.m. trading.

Tesla shares, which have been swinging wildly to start the year, fell 6.3% as of 4 p.m. Deep price cuts across the company’s U.S. lineup this month sparked a backlash from customers, many of whom paid thousands of dollars more for their vehicles just weeks earlier.

GE Healthcare Technologies shares gained 2%, on pace to be one of the best performers in the S&P 500, after the company reported its first quarter as a standalone publicly traded company.

Subscribe to The Economist today and enjoy savings of 70% Off

Global bond yields rose, after a surprisingly strong inflation reading from Spain muddied the outlook for interest rates in the eurozone.

The yield on the benchmark 10-year Treasury note climbed to 3.550% from Friday’s 3.517%. Bond yields and prices move in opposite directions.

The European Central Bank and the Bank of England are expected to raise interest rates this week, with policy decisions due on Thursday. Inflation in Europe has yet to show the sustained decline that has been witnessed in the U.S.

“There is an emerging divergence between the Fed and the ECB,” said Charles Diebel, head of fixed income at Mediolanum International Funds. “The forward-looking inflation data continues to move south in the U.S. In Europe, and it is clear that the data isn’t yet doing the same.”

In commodity markets, oil prices fell. Brent crude, the international oil benchmark, dropped 2% to $84.90 a barrel.

Overseas stock indexes diverged. In Europe, the Stoxx Europe 600 fell 0.2%, led by losses for technology companies.

Asian indexes were mixed as markets in mainland China and Taiwan reopened following the Lunar New Year holiday. Moves ranged from a 2.7% loss for Hong Kong’s Hang Seng Index to a 3.8% gain for Taiwan’s Taiex index.