Markets

Florida Homeowners to Pay Higher Premiums as Reinsurers See Risks and Pull Back

Storm risks and a wave of questionable claims lead to another year of higher rates

Home insurance rates are going up again in Florida, as rate increases by reinsurers get passed on to homeowners.

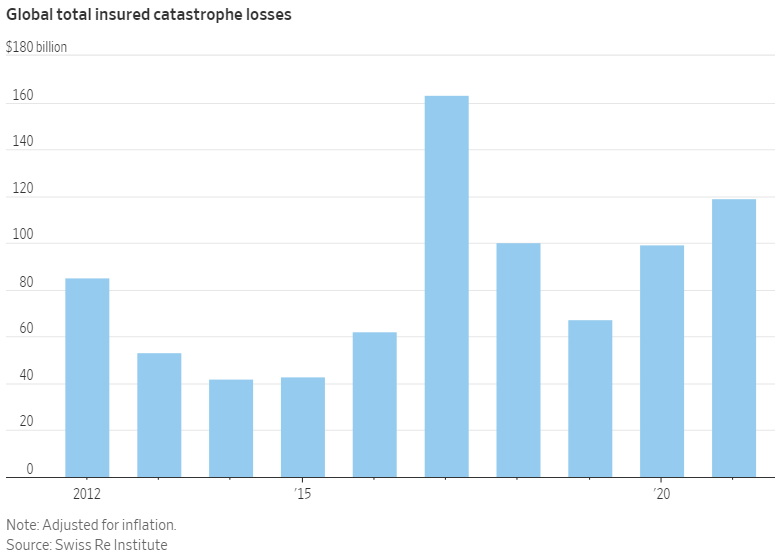

Reinsurers are reacting partly to five years of outsize losses from catastrophes around the globe, though Florida has been largely spared. Many are concerned that storms and wildfires are intensifying as a result of climate change. Reinsurers backup insurers, helping them pay claims.

There’s another driver for higher rates in Florida. The state suffers from what insurers see as sham roof claims and excessive litigation tied to these claims. Those costs have hurt profits for insurers and reinsurers. The state has passed legislation to limit the lawsuits but insurers say problems persist.

Buy WSJ Digital Subscription 3 Years WSJ Online Reading Buy Now and Get 70% Off

The reinsurers’ pullback in Florida drove up prices for insurers and homeowners as Florida-focused home insurers lined up contracts for this year’s hurricane season. Negotiating those pacts is a springtime ritual in the Sunshine State.

This year’s process was “just nasty” due to limited availability and higher prices, said Joseph Petrelli, president of Demotech Inc., a ratings firm with expertise in Florida’s residential property-insurance market. Many of the prices were up 15% to 25% this year, he said.

Many Florida homeowners will face premium increases of 5% to 10% to help their carriers pay for the more-expensive reinsurance, said Kevin McCarty, a former Florida insurance commissioner whose Celtic Global Consulting specializes in insurance.

Floridians already pay some of the highest home-insurance premiums in the nation, at an average of $4,231 this year, according to projections by trade group Insurance Information Institute. Rate increases are subject to regulatory review.

Buy WSJ Digital Subscription 5 Years WSJ Online Reading Buy Now and Get 70% Off

Florida homeowners’ premiums have risen at double-digit rates in recent years partly to compensate insurers for losses from the roof claims and litigation. The state’s last major hurricane was Michael in 2018.

“This is a catastrophe of a different kind,” Mr. McCarty said of the escalating reinsurance cost and resulting fallout. Any rate increases “will seriously impact Florida homeowners given the staggering inflation across the broader economy.”

Insurance regulators typically require the Florida-focused carriers to buy reinsurance to ensure they can make good on claims. These insurers, along with a state-backed insurer of last resort, have constituted the bulk of the Florida home-insurance market ever since most large national home insurers pulled back in the wake of devastating Hurricane Andrew in 1992.

Many carriers that sell reinsurance, including AXA XL and American International Group Inc., have reduced catastrophe exposure to limit earnings volatility, according to Fitch Ratings. Axis Capital Holdings Ltd., meanwhile, is entirely exiting the property reinsurance business. Others, such as giant Swiss Re, have specifically reduced business in Florida because they believe prices are too low.

Randy Fuller, a managing director who heads up the Florida segment for the Guy Carpenter reinsurance-brokerage unit of Marsh McLennan, calls it “the most challenging market” he has seen in 18 years in the industry. “The market conditions aren’t driven by a lack of reinsurance capital, but there’s a reluctance to put that capital at risk in Florida,” he said.

RenaissanceRe Holdings Ltd. has pulled back substantially over the past five years because “even the best underwriter with the most sophisticated model cannot price for unrelenting fraud and an aggressive trial bar,” Chief Executive Kevin O’Donnell said.

Questionable claims often involve roof damage that homeowners claim is from wind or hail. The carriers’ engineers and adjusters often see it as normal wear and tear. Industry executives say that Florida law allows too-easy access to insurer-paid legal fees in claims disputes, and that this encourages contractors to drum up business and lawyers to sue.

WSJ And Barrons News Digital Combo Offer 5 Years Buy Now

Contractors and plaintiffs’ lawyers accuse the insurers of exaggerating the role of fraud in their poor financial results.

Florida state lawmakers have approved measures in recent years aimed at curbing the litigation. The plaintiffs’ lawyers contend such moves can hurt consumers by limiting legal recourse against insurance companies. So far the lawsuits have kept coming, regulators and insurers say. The latest measures were approved in late May.

The backdrop for reinsurers is five years of elevated catastrophes around the globe that have hurt their results, including rapidly spreading U.S. wildfires, an unusual deep freeze in Texas and extensive European flooding. Besides Michael in 2018, Florida absorbed landfall from Irma in 2017.

Some reinsurance executives are worried about larger and more frequent disasters. Among these, Axis Chief Executive Albert Benchimol said the company’s exit from property reinsurance is driven partly by “the impact of the increasing effects of climate change.” He said the company sees “more consistent profitable results and lower earnings volatility” in other insurance lines.