Markets

Icahn Denounces Short Seller Amid Federal Investigation

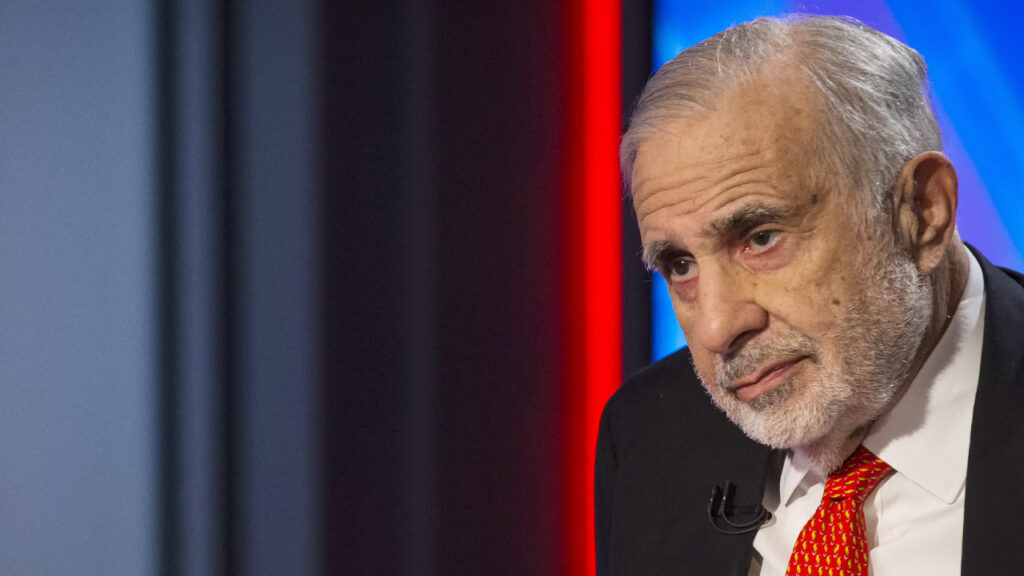

Activist investor Carl Icahn, currently under Federal Investigation for his investment practices, launched a strong criticism against the short seller that likely triggered the probe. He accused the short seller, Hindenburg Research, of recklessly causing damage and harm.

Icahn Enterprises, the publicly traded firm controlled by Mr. Icahn, became the target of Hindenburg Research earlier this month. Shortly after, the U.S. Attorney’s Office for the Southern District of New York initiated a Federal Investigation and requested information regarding the firm’s assets, corporate governance, dividends, and other relevant topics.

Icahn Enterprises, which is 84% owned by Mr. Icahn, stated that it is fully cooperating with the investigation and does not expect a significant impact on its business.

In response to Hindenburg’s accusations, Mr. Icahn referred to their tactics as equivalent to wanton destruction and harm. He also expressed confidence in Icahn Enterprises’ ability to fight back, emphasizing the liquidity, strategy, and expertise they possess.

Get The New York Times and Barron’s News 3-Year Digital Subscription for $129

Previously, Mr. Icahn had only issued brief statements confirming the payment of the company’s quarterly dividend and alluding to the long-term performance speaking for itself.

Hindenburg Research, a well-known short seller, alleged that Icahn Enterprises relied on inflated valuations and excessive leverage, causing their trading value to exceed their actual held assets. Concluding that confidence games ultimately expose themselves, they predicted that Icahn Enterprises would encounter the same fate.

As a result of the Federal Investigation, Icahn Enterprises experienced financial losses, with a first-quarter loss of $270 million compared to a profit of $323 million during the same period last year. The company’s investment portfolio suffered from their own short bets, resulting in a $443 million loss in the quarter. Furthermore, the value of one of the holdings highlighted by Hindenburg as overvalued was written down.

Get Wall Street Journal Digital and The Economist 3-Year Combo Package for $129

Icahn Enterprises acknowledged potential write-downs, including a real estate portfolio valued at $457 million, with a commercial high-rise property worth $218 million defaulting on its lease. The company may consider taking an impairment charge in the second quarter due to these developments.

Icahn Enterprises maintained, despite Hindenburg’s critiques, that they properly valued their assets using accepted methodologies and sold their historical investments at a premium to book value.

Icahn Enterprises confirmed their commitment to paying dividends, a major attraction for individual investors who constitute the majority of its public ownership. Mr. Icahn and his affiliates, who own approximately 84% of the company, historically opt to receive dividends in shares rather than cash, reducing cash outflows. With the decline in share price, the stock now yields approximately 23%.

Additionally, Icahn Enterprises announced that its board, chaired by Mr. Icahn, authorized a $500 million share buyback program and an equivalent amount for bonds. The company disclosed having $1.9 billion in cash reserves.