Real Estate, U.S. News

U.S. Existing-Home Sale Prices Hit Record of $407,600 in May

Home sales decline 3.4% as mortgage-interest rates climb

The relentless climb in U.S. home values continued in May, when median prices shot above $400,000 for the first time while sales activity slowed under pressure from higher mortgage costs.

Rapidly rising interest rates are rippling through U.S. markets as the Federal Reserve tries to combat inflation. Stocks entered a bear market this month, consumer sentiment has taken a hit, and economists are forecasting an increasing likelihood of recession as higher rates threaten to choke off growth.

But home-buying demand continues to exceed unusually low levels of supply and propel prices higher. The median existing-home price rose 14.8% in May from a year earlier to $407,600, a record high in data going back to 1999, the National Association of Realtors said Tuesday. That rate was up slightly from the previous month.

Buy WSJ Digital Subscription 3 Years WSJ Online Reading Buy Now and Get 70% Off

The combination of rapidly rising rates and record home prices is squeezing many buyers out of the market and making it especially challenging for first-time buyers.

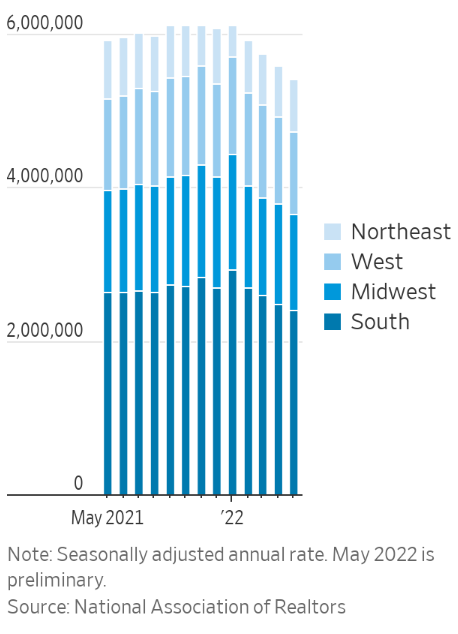

These factors are cooling off the frenetic sales pace that started two years ago when pandemic-related restrictions eased and buyers scrambled to find homes with more space. Sales of previously owned homes slid for a fourth straight month, declining 3.4% in May from the prior month to a seasonally adjusted annual rate of 5.41 million, the weakest rate since June 2020, NAR said. May sales fell 8.6% from a year earlier.

Many housing economists expect steeper borrowing rates to slow home-price growth in the second half of the year. The average rate on a 30-year fixed-rate mortgage was 5.78% in the week ended Thursday, the highest level since 2008 and up from 2.93% a year earlier, according to housing-finance agency Freddie Mac. The May sales data largely reflect purchase decisions made in April or March.

Buy WSJ Digital Subscription 5 Years WSJ Online Reading Buy Now and Get 70% Off

“The impact of higher mortgage rates have not been fully reflected in the data,” said Lawrence Yun, NAR’s chief economist. “In the upcoming months, I do anticipate a further decline in home sales.”

Mortgage applications to purchase homes have declined in response to rising rates. Two real-estate brokerage companies said last week they would lay off hundreds of employees due to decreased home-buying demand.

For now, economists largely expect home prices to keep rising even if the rate of growth is likely to ease. Doug Duncan, chief economist at Fannie Mae, said he expects year-over-year house-price growth of around 5% by the end of 2022.

“Even though rates are constraining affordability, there’s still the existing supply and demand imbalance,” he said. “House prices have a lot of momentum.”

Nearly 60% of the homes sold in May were sold above their list price, according to real-estate brokerage Redfin Corp.

Inventory has risen sharply in some markets, though from very low levels. In the Austin, Texas, metro area, active listings in May surged 146% from the prior year, according to the Austin Board of Realtors. In the Denver area, active listings climbed 76% year-over-year in May, according to the Denver Metro Association of Realtors.

WSJ And Barrons News Digital Combo Offer 5 Years Buy Now

Buyers are still making aggressive offers because they are eager to lock in purchases in case interest rates rise further, said Mike Ferrante, a real-estate agent in the Cleveland area. He listed a home in May and got three offers, all over list price and offering favorable terms, he said.

“When you start to see homes sitting on the market for more than a few days, the buyers are going to figure out that the competition is diminishing,” he said. “I do believe there’s going to be a slowdown.”

The typical home sold in May was on the market for 16 days, down from 17 days from the prior month, NAR said.

The spring is often the busiest season for home sales, with 40% of typical existing-home purchases occurring between March and June, according to NAR.

Consumers are feeling pessimistic about the housing market. Only 17% of consumers surveyed by Fannie Mae in May said it was a good time to buy a home, down from 35% a year earlier and a record low in data going back to mid-2010.

Michelle Zuniga said she backed out of a contract to buy a newly built home in LaBelle, Fla., in May after the builder raised the price by $49,500 to account for increased costs. Between the higher price and rising mortgage-interest rates, she could no longer qualify for a loan, she said. Ms. Zuniga is now considering relocating to Georgia for more affordable housing.

“I’m very upset that this happened,” she said. “You feel lost in the sense that I want to move forward, I want to invest, and I’m not able to do that.”

Existing-home sales fell the most month-over-month in the West and Midwest, down 5.3% in both regions.

Home builders have been slowed by supply-chain issues and labor shortages. A measure of U.S. home-builder confidence fell in June to the lowest level in two years, the National Association of Home Builders said last week.

“We’ve seen our traffic really drop off,” said George Hale, president of builder Woodhill Homes in Bend, Ore. “As appreciation has gone up and then you add on the factor of rates going up…it’s just become too expensive.”

Housing starts, a measure of U.S. home-building, fell 14.4% in May from April, the Commerce Department said last week. Residential permits, which can be a bellwether for future home construction, dropped 7%.