Subtotal: $480.00

Markets

Current Market Trends Tells Where The Economy is Going According to Six Top Economist

Reogocorp reports the independent study conducted by six top economists show the continuance of inflation through next year will affect world economies until 2028. A crash in tech stocks, a bond sell-off, and the implosion of cryptocurrencies have cause fear in the stock market.

In the midst of uncertainty, we seek the most important experts in the world of finance to find out their opinion on the current markets, and how they have handled the chaos of this year and what the expectation is for the next.

Subscribe today and get 52 weeks of The WSJ Print Edition for $318

Market watchers disagreed on some fundamental issues. Jeremy Grantham, best known for predicting the market crashes of 2000 and 2008, gave plenty of reason to be bearish even after the initial burst of what he called “a super bubble.” Investment pioneer Rob Arnott, the founder of Research Affiliates, agrees that the market hasn’t bottomed out yet. Lloyd Blankfein, former CEO of Wall Street giant Goldman Sachs Group Inc., GS 1.38% increase; The green triangle pointing up says that things are not as bad as they seem.

The vast majority agree that the situation will not ease soon.

Wait for the Peak of Fear

Investors should wait until markets have bottomed to buy, says Mr Arnott. And that hasn’t happened yet, in his opinion.

It is very difficult to decide when to buy; if you rush to buy, your investments will fall even more. But if you buy too late, you will lose the best opportunity.

US stocks still look expensive to Arnott, the son of a pastor who turned his love of computers, math and research into an investment advisory firm, Research Affiliates. He is known within the industry as the “godfather of smart beta,” a reference to funds that allocate money based on factors like dividend payments, sales, or company volatility.

Buy The New York Times and The Economist subscription for 3-years.

The problem is identifying the moment of greatest fear, when investors have become so bearish that prices can only go up, almost always comes down to guesswork, Arnott said.

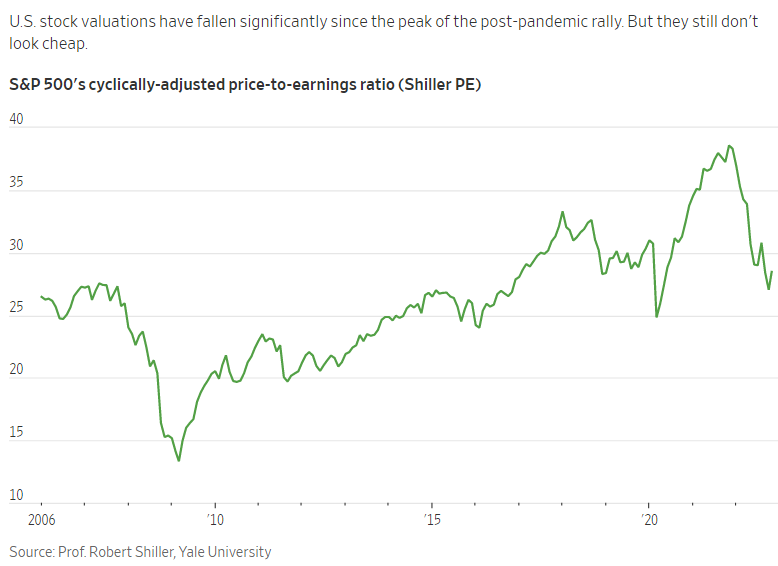

He mentions that US stocks have not bottomed out. Why? Shiller’s price-earnings ratio, this is a measure of market valuation and shows that stocks remain relatively expensive. The S&P 500 is well above the range reached in the 2007 financial crisis. That doesn’t seem to suggest that investors have reached the point of capitulation.

“I’ve been called a permabear,” he said. “But I’m a bear on expensive things. I don’t want to bother buying them, even if they could go higher.”

—Akane Otani

Things are not as bad as they seem

According to Blankfein, who led Goldman Sachs through the brutal financial crisis of 2008-09, the market outlook may not be as dire as many believe.

People underestimate the fact that there is good news amid so much information accumulation, which could affect the market in a good way. Saudi Arabia reporting more oil and a pause in hikes by the Fed. Let’s remember that the markets are not just the current economy; they look to the future.

This year’s sell-off has punished many stocks as well, he said. “Move into the ones you wish you had but were too expensive.”

Mr. Blankfein said it is worth remembering that the moment’s challenges always seem worse than those of the past, if only because the past is resolved. And history, like markets, has cycles.

“Do you think things have never been scarier?” said Mr Blankfein, who retired from Goldman in 2018. “Really? We lived through the Cuban missile crisis when we stopped Soviet ships in international waters. Are these the most polarized times? I was in 1968 when there were murders of public figures when kids were blowing up recruiting centers, and the National Guard was shooting up campuses. We get through that; we get through this.

“It’s never as bad as your worst fears or as good as your best hopes,” he added.

—Justin Baer

Prepare for more mayhem

Volatility is here to stay. That is the opinion of Paul Britton, founder of the investment firm Capstone Investment Advisors and someone who bets on uncontrolled changes in global markets.

He mentions that even investments like bonds, considered safer investments compared to stocks, have become more volatile. He expects interest rate increases to continue to weigh on markets.

That makes many investors’ portfolios riskier than they seem, says Britton. The yield on the 10-year Treasury note, generally considered ultra-safe, has posted some of its biggest one-day moves of a decade in recent months.

Britton mentions a structural change that we have not seen in a decade. The strategies that worked these 15 years do not have to be the ones that work in the next 15.

At his firm, which oversees roughly $8.9 billion in assets and manages money for pension and endowment funds, Britton says he is particularly optimistic about a so-called dispersion strategy designed to profit from volatility. The complex tactic uses options to bet on how strongly stocks will rise and fall together.

“This is one of those times where I think it’s crucial to be brave in your decision-making,” said Mr. Britton.

—Gunjan Banerji

Inflation Will Not Go Away

Nancy Davis founder of the asset management firm Quadratic Capital Management LLC, which oversees approximately $1.2 billion. She said investors who are hoping inflation will dissipate soon shouldn’t.

This year the price of everything skyrocketed, from groceries to gasoline; inflation hit its highest in 4 decades. Federal Reserve Chairman Jerome Powell has clarified that he does not expect that situation to change. He said it was time to drop the term “transitional” when discussing this issue.

“The Fed pulled it back, but the market is still pricing in transients,” said Davis, who warned of the dangers of inflation earlier in 2021. “To me, that’s where there’s an opportunity.”

She cited the fact that inflation expectations among investors have been falling this year, even as consumer price data has shown continued gains. A widely followed measure of investors’ annual inflation expectations over the next half-decade, the five-year breakeven inflation rate recently stood at around 2.6%, according to Tradeweb. Year-on-year inflation is currently above 8%, well above the Fed’s 2% target. He said that investors expect inflation to fall over the next five years, and bond market investors may be too confident that the Fed’s rate hikes will eventually reduce inflation.

He is preparing by holding mostly inflation-protected bonds and interest rate-linked options in the $1.1 billion quadratic interest rate volatility and inflation hedge exchange-traded fund, where he is the manager portfolio. She said these positions would be a hedge if inflation doesn’t ease.

—Gunjan Banerji

Wall Street Journal and Barron's Print Subscription for 1 Year at 50% Off

Wall Street Journal and Barron's Print Subscription for 1 Year at 50% Off