Markets

Fed Reassurances Fail as Regional Bank Stocks Plummet

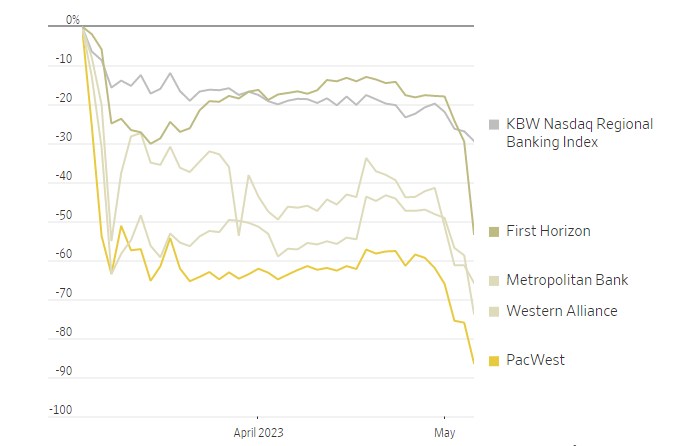

Despite the Federal Reserve’s assurance that the banking system is stable, Regional Bank stocks plummeted on Thursday.

PacWest Bancorp experienced a significant drop of about 42.60% since the beginning of the Regional Bank troubles in March, and its stock continued to fall in after-hours trading on Wednesday after reports that it was considering selling itself. However, PacWest reassured investors that its core customer deposits had increased since the end of Q1, and there have been no unusual deposit flows since the First Republic collapse.

The decline in PacWest and other banks reflects general concern about Regional Bank and not specific issues with PacWest, according to some analysts. Another bank, Western Alliance, has also faced a significant drop of more than a third.

Janney Montgomery Scott analyst Christopher Marinac called the decrease in bank stocks “a temper tantrum” following the Federal Reserve’s interest rate hike. Meanwhile, Wells Fargo Securities analyst Jared Shaw noted that PacWest and Western Alliance have stabilized on a fundamental level and are in a better position than First Republic with capital levels and deposits.

Get WSJ Print Subscription for $318

Separately, First Horizon’s shares fell by over a third after its $13.4 billion acquisition by TD Bank was called off because TD Bank was unsure if it would receive regulatory approval.

On Wednesday, the Federal Reserve stated that the U.S. banking system is sound and resilient, and deposit flows at banks have eased. Fed Chair Jerome Powell added that the worst was over after the collapses of Silicon Valley Bank, Signature Bank, and First Republic.

Despite this, the KBW Nasdaq Regional Banking Index fell by about 3.4%, and Metropolitan Bank, Comerica, and Zions Bancorp logged sharper declines of about 6% to 12%.

PacWest stated that discussions with several potential partners and investors are ongoing. While the bank has recently explored “strategic asset sales” to increase liquidity, it is smaller than some of the other better-known banks that have recently attracted investors’ scrutiny. At the end of December, PacWest was the No. 53 bank by assets in the U.S., according to the Fed.