Markets

What’s Keeping US Markets Serene?

The US Markets currently exhibit an unexpected state of tranquility, even amidst the ongoing debt-ceiling dispute. This calmness can be attributed to the widening gap between conventional investors, who largely remained on the sidelines during the 2023 stock rally, and the automated trading systems driving market activity.

With the debt-ceiling deadline rapidly approaching, the US teeters on the brink of potential turmoil. President Biden and Republican House Speaker Kevin McCarthy recently reached a preliminary agreement to avert a destabilizing default. However, there is no guarantee yet regarding the passage of the plan, and procedural obstacles have the potential to delay the final legislation.

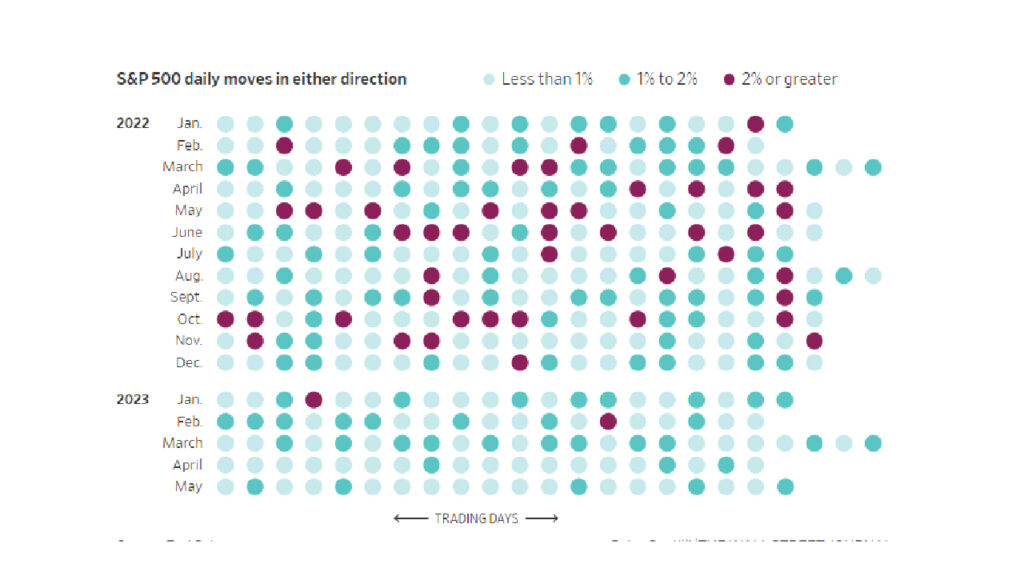

Despite the political uncertainties, the stock market has remained relatively unscathed, with the S&P 500 concluding the previous week 0.3% higher. In recent months, stocks have consistently overcome challenges such as banking system stress, persistent inflation, and interest rate hikes. Unlike last year, when these factors repeatedly caused market disruptions, the current response has been rather nonchalant.

The perplexing ascent of the market has left analysts and portfolio managers puzzled, as the S&P 500 has surged over 9% this year (with the technology-focused Nasdaq Composite rising 24%). One explanation lies in the increased activity of quant funds, which rely on computer models and automated trading. While other investors have grown cautious due to high valuations and concerns about the US economy’s trajectory, quant funds have doubled down on equity markets.

According to data from Deutsche Bank, quant funds’ net exposure to US stocks has reached its highest level since December 2021. Conversely, mainstream investors have been withdrawing funds from stock investments and redirecting them toward money markets.

Get Wall Street Journal Newspaper for $318

While quant funds have provided a tailwind for stocks, they also pose a potential risk if the debt-ceiling agreement falters. Concentrated positioning within these funds could lead to unwinding in the event of a negative shock. The risk lies not only in their equity holdings but also in the possibility of leveraging.

Although the market has displayed signs of stability, there have been early indications of eroding tranquility. Last week, the Cboe Volatility Index (VIX), commonly known as Wall Street’s fear gauge, briefly rose above 20 for the first time in three weeks as concerns regarding the debt ceiling emerged. A VIX reading above 20 typically signifies an increase in fear.

For now, the ongoing demand from quant funds has served as a lifeline for the stock market. Coupled with robust corporate buybacks, their buying activities have counteracted selling pressure and contributed to placid market movements. The S&P 500 has experienced less than a 1% move in either direction during 36 of the last 46 trading sessions, marking the calmest 46-day stretch since December 2021.

Get Wall Street Journal 2-Year Print Subscription for $480

Deutsche Bank strategist Parag Thatte notes that systematic and fundamental investors have rarely been so divergently positioned since 2019, with the dominance of quant funds driving this disparity.

When market volatility diminishes, quant funds increase their involvement, creating a self-reinforcing cycle. This was evident during the spring when significant stock-market movements subsided due to regulatory interventions and indications from the Federal Reserve regarding a potential halt in interest rate hikes.

The presence of quant funds has previously explained periods of serene trading, including extended stretches in 2017 and 2018. However, these calm periods were occasionally disrupted by sudden sell-offs, such as the 2018 “Volmageddon” episode, where market dynamics that maintained stability abruptly shifted. Some analysts caution that a similar scenario may lie ahead.

Treasury Secretary Janet Yellen has warned that the US could begin missing payment obligations as early as June 5 unless Congress takes action. While investors have not yet considered this event a significant risk to stocks